The challenges surrounding Know Your Customer (KYC) regulations are long-standing and wide-ranging. Since anti-money laundering (AML) legislation first entered the legal sphere in the US back in the 1980s, the complexity surrounding KYC has grown markedly – as have the resources that it consumes.

These pain points are particularly noticeable for treasurers. Some of the most prominent include the lack of a central location to store KYC documents, a lack of clarity regarding KYC requirements, and wasted time reformatting documents to meet third-party requirements. In particular, the manual collection and verification of KYC data may take days – and an enhanced due diligence process could take even longer.

However, the large amounts of time and money taken up by verification and validation within the KYC process can be reduced. For treasury managers, tools like CoorpID can decrease the time you spend on your KYC process, reduce complexity, and prioritise security.

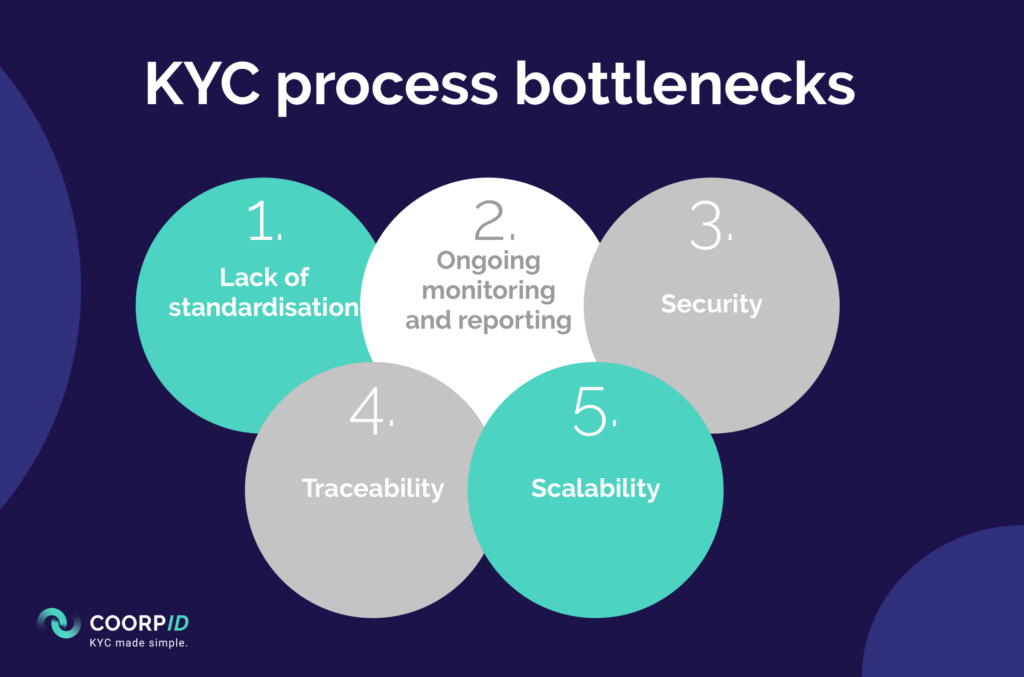

The aim of this article is to help you identify and eliminate your KYC bottlenecks.

Bottleneck 1: A lack of standardisation

Every financial institution that is conducting business with a corporate client will require corporates to perform KYC from scratch. For clients, this means providing multiple different versions of the same information to satisfy each counterparty’s KYC requirements. There is currently no standardisation around these data requests and this lack of consistency can lead to confusion, mass duplication, and delay.

With corporates often having several global banking relationships requiring them to supply KYC information, the absence of a common standard causes a significant drain on resources and results in unnecessary inefficiency.

- How CoorpID can help:

More than just a KYC tool, CoorpID aims to become a holistic digital identity platform that treasurers can rely on. Our solution, with its streamlined approach to sharing and requesting KYC information, helps build trust in digital identity. As such, it supports a broader movement toward KYC standardisation.

At CoorpID, we have created a platform that offers a single digital vault that enables all parties to gain a collaborative view of the current KYC status. CoorpID was co-created with 10 large corporate clients to ensure that it is able to offer a standardised approach that works for everyone. Documents can easily be reused by multiple FIs, saving corporates 3,200 hours annually on their KYC processes.

Bottleneck 2: The challenge of ongoing monitoring and reporting

One of the most commonly identified KYC bottlenecks stems from the fact that the customer due diligence (CDD) process is never complete. Client circumstances change, which means that KYC and AML data must be regularly refreshed to ensure compliance – particularly given the constantly shifting regulatory landscape.

Continuous monitoring of financial activity is needed to collect new data to verify customer information, so that action can be taken if it is not consistent. The process of ongoing KYC monitoring has been made more challenging as a result of the Covid-19 pandemic due to financial pressures and restrictions on in-person interactions. In fact, 65% of compliance managers admit to taking shortcuts with KYC and due diligence checks.

- How CoorpID can help:

The CoorpID platform facilitates CDD by enabling easy collaboration around every CDD review. Corporates can share information for CDD purposes – whether they are working with a single FI or multiple banks.

Bottleneck 3: Security

The financial sector has always been a prized target for cybercriminals due to the sensitive nature of the data it holds and the potential rewards for a successful attack. In 2020, for example, the average cost of a cyberattack leading to a data breach at a corporate entity was found to be $3.86 million. Data privacy and having centralised storage that you can trust are essential when executing your KYC process, particularly if it concerns the personal and sensitive data of your company and employees. Of course, this takes time, but its importance cannot be overstated.

- How CoorpID can help:

Security is an important consideration within the CoorpID platform. In addition to access management features that ensure only individuals with the right authorisations can access sensitive information, the platform boasts robust security standards. These include the same banking standards used to protect sensitive information at FIs. In addition, two-factor authentication (2FA) is employed as an additional safeguard.

Bottleneck 4: Traceability

Effective KYC requires input from multiple individuals and organisations. Research suggests that as revenues increase, corporate compliance teams also expand in size – increasing the likelihood of documents being misplaced and deadlines forgotten. In fact, a recent survey found that 31% of respondents believe that their compliance team is set to grow over the next 12 months. How can you keep track of this complexity without subjecting yourself to manually tracking countless emails and messages?

- Connection to CoorpID:

The CoorpID platform provides a full audit trail of the KYC process and any associated discussions so it’s possible to look back through the process, assign responsibilities to the appropriate compliance personnel, and identify any bottlenecks. The audit view supplies an overview of any changes, providing organisations with accountability.

Bottleneck 5: Scalability

For corporate treasurers to have total control over their data regardless of its scale, a flexible regtech solution is needed that complements existing tools and processes. As has already been made clear, one of the biggest causes of KYC bottlenecks is its size and breadth. As KYC regulations become increasingly stringent, the amount of data that needs to be collected and processed is only likely to grow. The right KYC tools can allow distinct requests to become part of a continuous workflow with set rules, mitigating challenges around scale.

- Connection to CoorpID:

With CoorpID, you can easily see all your relevant KYC relationships in one clear overview, including the number of entities involved and the amount of data required. As a cloud-based collaboration platform, CoorpID lets you stay up-to-date with document statuses and quickly delegate tasks, so it doesn’t matter how large and complex your KYC process becomes – CoorpID can manage it all and present it simply.

How you can stay up to date with KYC standards

Last year, the European Union’s 6th AML Directive came into force and it is unlikely to be the last. The finance sector is continuously evolving due to technological developments, impacted by everything from fintechs to cryptocurrencies. Unexpected external shocks, like the Covid-19 pandemic, also necessitate regulatory shifts. As such, it is more important than ever that FIs and corporates have access to the right KYC tool, one that is agile, adaptable, and that cuts down on the kinds of bottlenecks set out above.