Businesses could be forgiven for finding the sheer breadth and scale of KYC regulations a little overwhelming. When they explore how much time and money is being spent by other organisations on achieving compliance, they may well be in for another shock. On average, banks spend $48 million every year on KYC compliance.

The good news is that, in most cases, financial institutions (FIs) and corporates that are struggling with KYC compliance are doing so unnecessarily. Today, a variety of compliance software is available to firms that are looking to conduct customer due diligence (CDD) and adhere to the latest anti-money laundering (AML) rules.

Not so long ago, the KYC process was largely a manual affair and the tools used to provide support were fairly rudimentary. For example, when onboarding a new customer, FIs and other companies simply had to train their staff to identify suspicious behaviour and recognise authentic personal documents. Some KYC files could be stored digitally but retrieving them for subsequent KYC processes was again a manual, laborious affair.

The evolution of regtech tools has meant that modern KYC processes need no longer be a burden, but each KYC tool is different and comes with its own strengths, weaknesses, and unique features. Ultimately, an organisation’s KYC tool of choice will influence how it carries out its KYC process because the two are intrinsically connected.

Below, we’ve listed three key areas where a company’s KYC tool has a significant impact on its KYC process.

Efficiency

As KYC regulations have become more complex, KYC processes have developed to reflect this. This means FIs may need a multitude of different documents in order to verify the identity of a single customer and assess the risk of entering into a relationship with that customer. Subsequently, a different business unit, perhaps within the same organisation, may need to ask, once again, for those same documents as part of a different KYC process. Often, any differences concerning the required documents will be minor, but the FI will have little choice but to start the process all over again. These duplicate processes waste time, energy, and money.

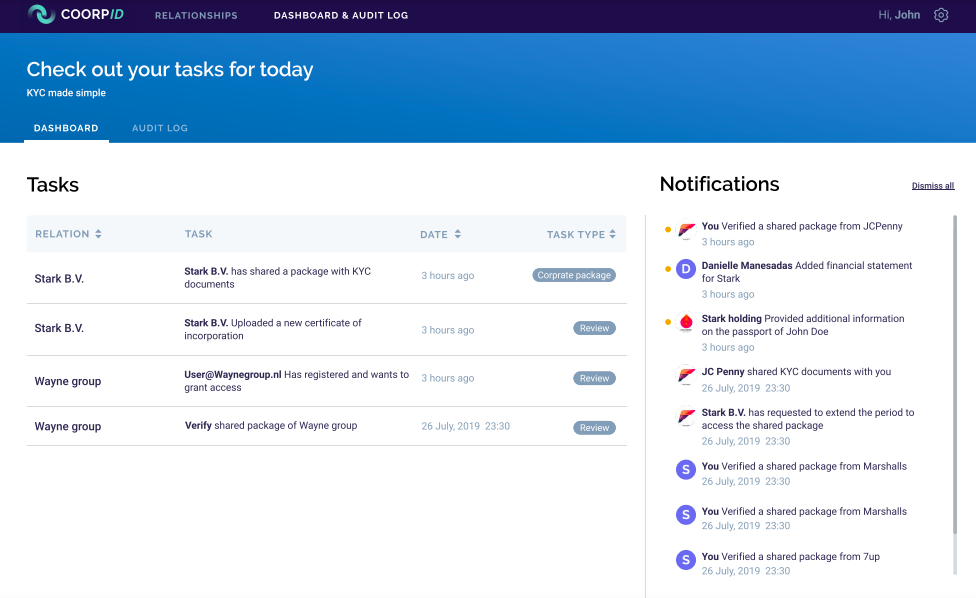

Similarly, corporates frequently hold multiple banking accounts with several FIs and their subsidiaries – leading to a fragmented and overly long process. The duplication of files and the need to work through repeat procedures with other FIs can create lengthy and inefficient processes. KYC tools can provide corporates with a clear overview of all their FI relations in one single place. Allowing them to prioritise which KYC processes need attention and what documents need to be sourced.

Fortunately, FIs and corporate teams are increasingly looking at how adopting a single KYC solution can remove some of the inefficiencies that have blighted the KYC process. Utilising a single, unified KYC repository allows data sharing between teams, reducing the need for duplicate KYC document requests. KYC personnel can quickly and easily look up the status of a particular customer, see transaction reports and other essential information.

Connected to these efficiency gains, organisations are also seeking KYC tools that place significant value on simplicity. The most effective KYC tools present a single, digital vault that enables KYC analysts to collect, organise, and track all the relevant documents they need. Similarly, many tools streamline the onboarding process by standardising the types of information required in order to carry out customer due diligence.

However, no matter how efficient any KYC tool is, no organisation can afford to operate without a first-rate KYC or CDD analyst. Manual processes will still be required and regulatory knowledge will prove valuable as FIs and corporates look to manage risk, prevent fraud, and achieve compliance.

As well as leading to better corporate compliance, having a KYC tool that improves process efficiency will also reduce friction during customer engagements by speeding up the KYC journey. Where KYC tools lead to the standardisation of inputs, they also lead to the standardisation of processes, and that adds value to internal KYC teams and customers alike.

Security

Digital tools may have brought efficiency benefits to the KYC space but they have also introduced risk. A quick online search for technology headlines will show various incidents where digital tools contained undisclosed vulnerabilities that eventually led to sensitive information ending up in the wrong hands. In 2019, for example, a cryptocurrency exchange found itself the victim of a data breach, resulting in a significant proportion of its KYC data being stolen.

KYC solutions must embrace strong authentication credentials and encryption and, in addition, they must continually test and verify their security protocols to make sure that they remain fit for purpose. For businesses to feel secure in their KYC process, it is also useful to adopt KYC tooling that facilitates a certain degree of configuration. Each KYC process will require access from different teams and personnel, so KYC administrators must have absolute control over which individuals can access certain types of information. Audit functionality will also prove useful as a means of keeping track of any changes made within a particular KYC tool – providing an added layer of transparency.

Having a secure KYC tool in place also enables FIs and corporates to develop a more collaborative KYC process. Increasingly, industry collaboration is seen as vital to tackling KYC challenges. With more collaboration, internal teams and external partners can share relevant data more easily, identify compliance needs across different jurisdictions, and access up-to-date information. But collaboration can only take place if organisations have confidence in the security of their KYC solution. Without it, every shared data point comes with a significant amount of risk.

Innovation

KYC tools have shown an impressive willingness to embrace innovation. Artificial intelligence (AI), cloud-based API tech, digital identity solutions, and even blockchain are being used to bring new innovations to the KYC process.

AI-powered KYC tools, for example, have helped organisations to track malicious transactions, adjust their anti-money laundering protocols and better manage risk. Automation has allowed FIs to comb through vast amounts of data in a fraction of the time it would have taken manually, extracting meaningful information so that it can be looked at in more detail by KYC analysts.

Similarly, cloud-based APIs allow FIs to access the latest updates without having to upgrade their internal IT infrastructure. Every update is handled by the cloud service provider, with new features coming as part of the OPEX costs agreed within a subscription payment plan. Because KYC regulations change frequently, KYC tools that can be seamlessly updated are essential for businesses to remain compliant. Processes may have to change, so it’s vital that tools are adaptable as well.

Furthermore, many KYC tools are adopting digital identity solutions – something that is increasingly important as more FIs adopt a digital onboarding process. Even before the coronavirus pandemic, digital identity verification was becoming more popular, with the market predicted to experience 20% year-on-year growth over the next six years. Many KYC tools now provide document verification, facial recognition, and other anti-money laundering checks to ensure that FIs and corporates can manage a digital KYC process.

Finally, blockchain, a technology more commonly associated with cryptocurrencies like Bitcoin, has also been tentatively explored with regard to KYC solutions. Because data stored on the blockchain is inviolable and decentralised, it could one day be used to create a secure, registry for FIs and corporates to store KYC information.

For now, however, FIs and corporates will have to choose their KYC tool carefully, evaluating the specific needs of their industry, clients, and geographical jurisdiction. The right tool could significantly reduce the financial strain of meeting KYC regulations, while also delivering a smoother process for employees and customers alike.

At CoorpID, we have created a platform that makes the KYC process simpler for both FIs and corporates. For FIs, we make it easier for teams to receive, review and delegate documents in a secure, collaborative space. While for corporates, our digital vault lets organisations store all their KYC information, communication, and requests in one place.

To find out how CoorpID can greatly reduce the time and money being expended on your KYC processes, while continuing to deliver on your compliance needs, reach out for a free demo here.