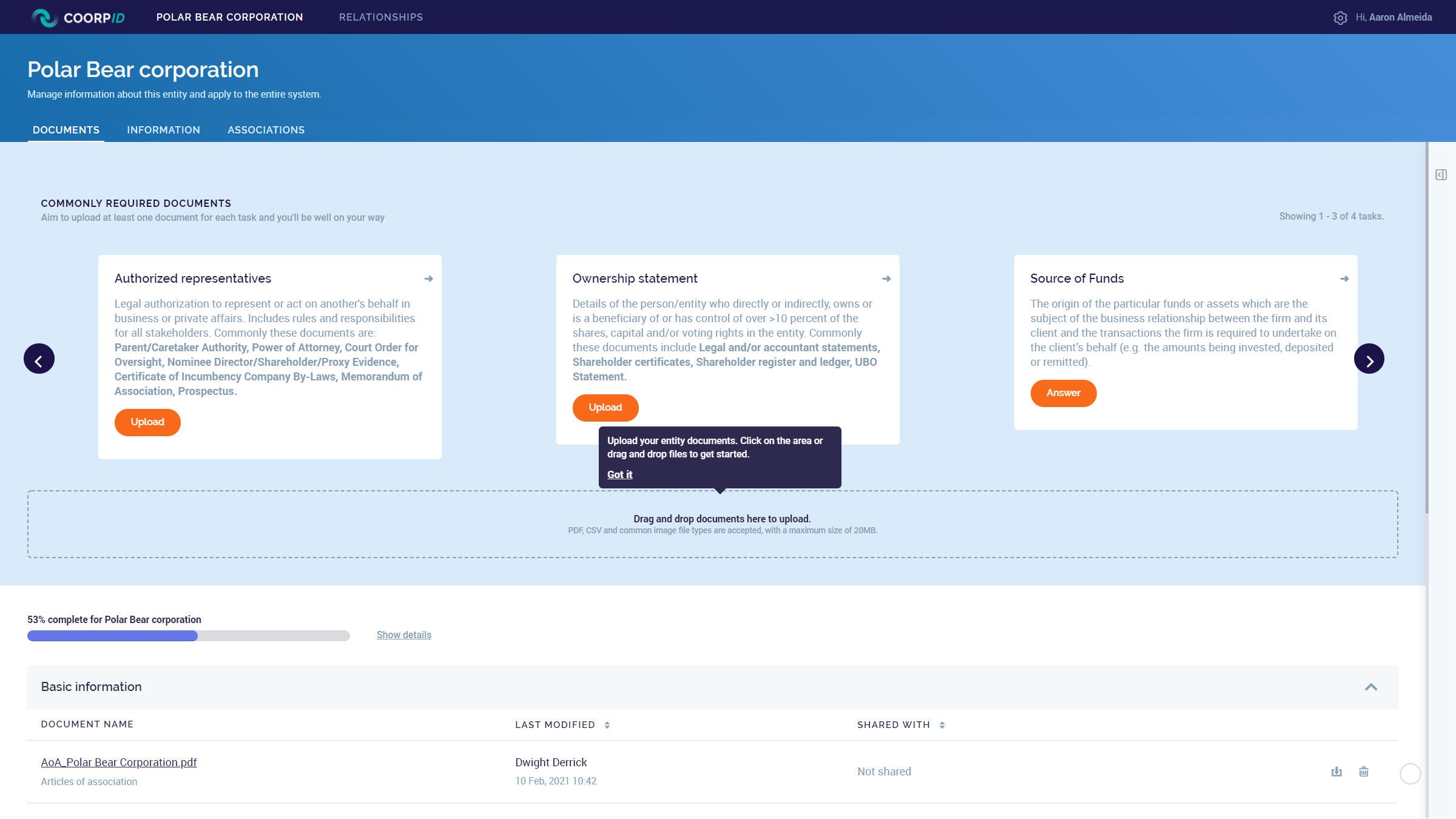

You can start with uploading documents related to your corporation’s entities and individuals when you have created your first entities and/or accepted an Invite for review.

- Click ‘Entities’ or ‘Individuals’ from the menu. From there you can navigate to the specific page of your Entity/Individual.

- For Commonly required documents, simply click ‘upload’ for the document type you would like to upload. PDF, CSV and common image file types are accepted, with a maximum size of 20MB.

- Use the drag and drop bar to upload one or more documents at once.

- CoorpID will ask you to categorize the documents. Simply select one of the categories from the drop-down list.

- If the correct category is not available from the drop-down list, you can select ‘Other categories’.

- When you would like to further specify the document type, select the name of the document from your documents list.

- On the document page, select ‘Info’ > ‘Document type’. You now have the option to create a new document type by simply typing a new name.

Besides the documents you upload, CoorpID generates some documents itself based on the information you provide. These ‘System generated’ documents (i.e. Ownership structure) can be used and downloaded too. When you update your information/structure, these documents automatically will be updated as well.

(Please note: System generated documents cannot be deleted.)

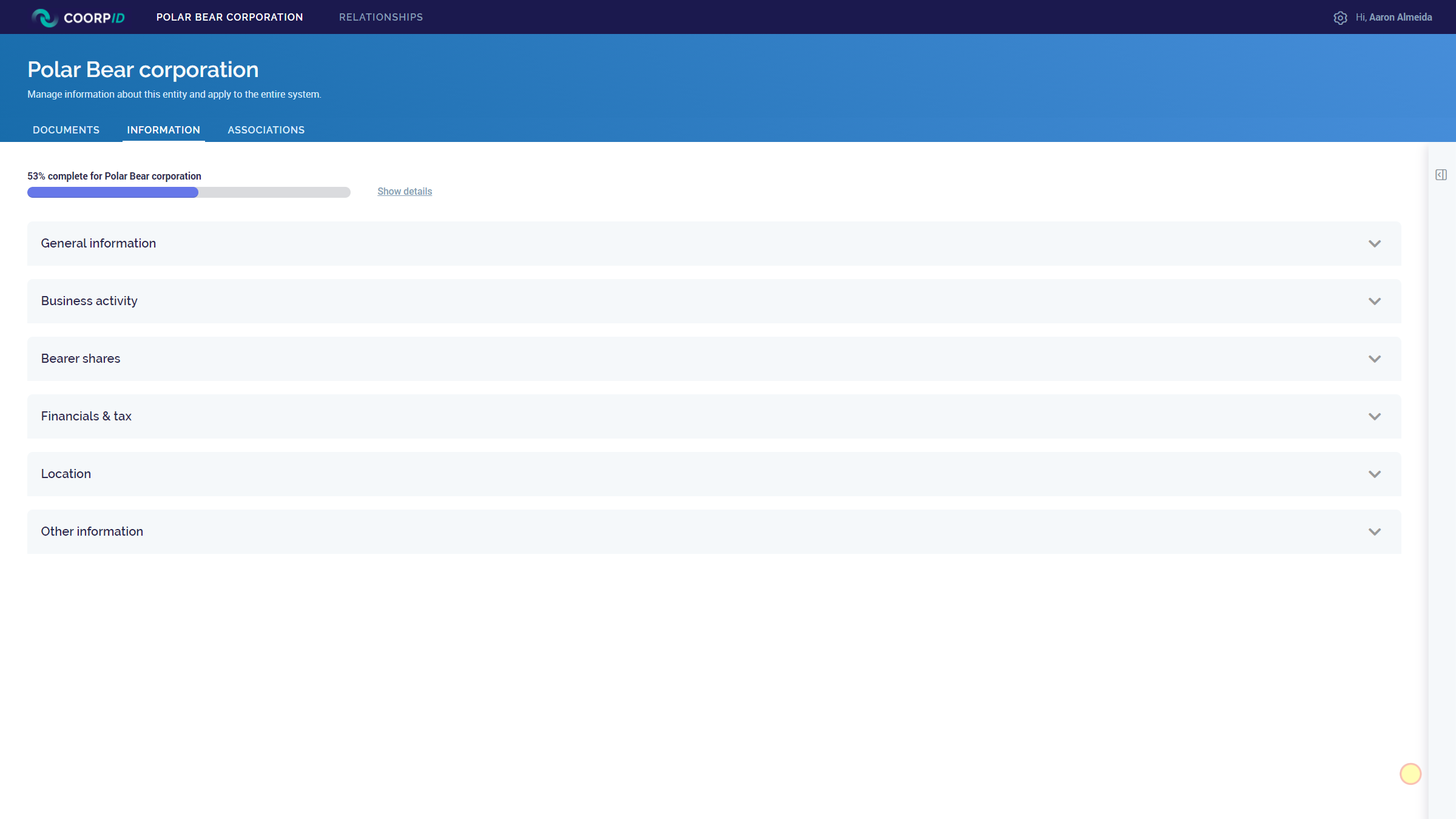

Specific entity information can be edited under the ‘Information’ tab. The information provided here will automatically update the following system generated documents:

- Entity information

- Entity tax information (only for Financials & tax)

You are well on your way now, add Relationships to start sharing with partners.